The importance of Village Savings and Loans Associations

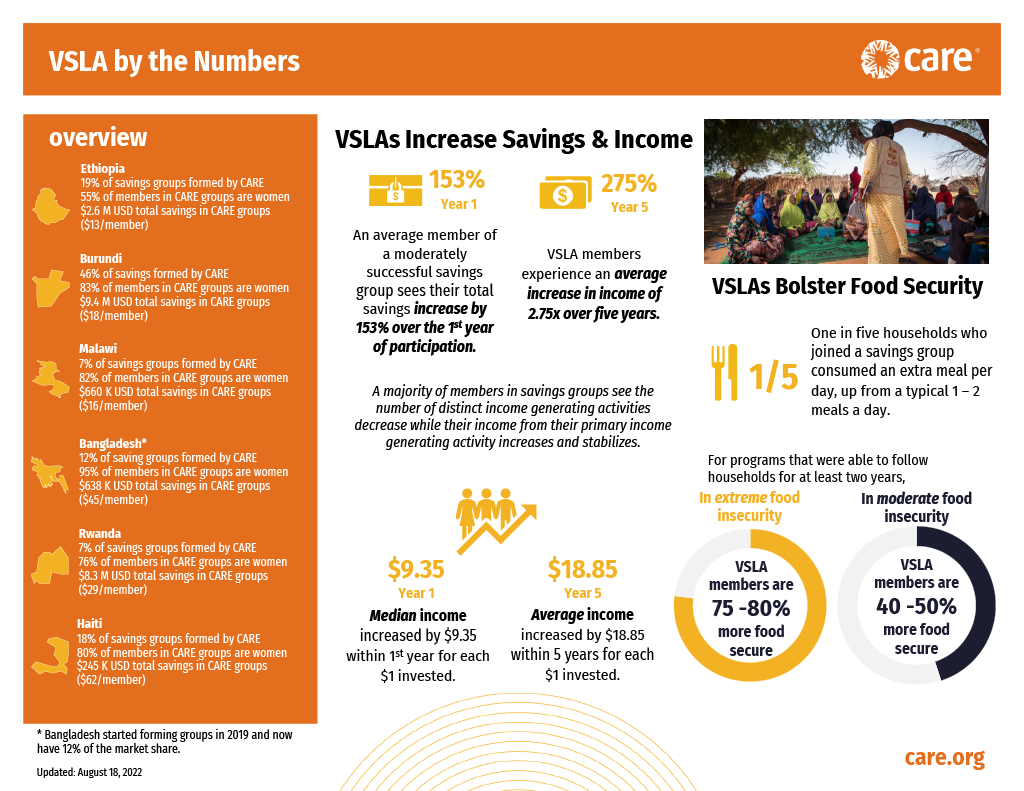

Village Savings and Loan Associations, or VSLAs, are community-based financial groups that have been used for decades to provide access to financial services in rural and low-income areas. VSLAs typically consist of 10-25 members who come together to save money, pool their resources, and lend to each other.

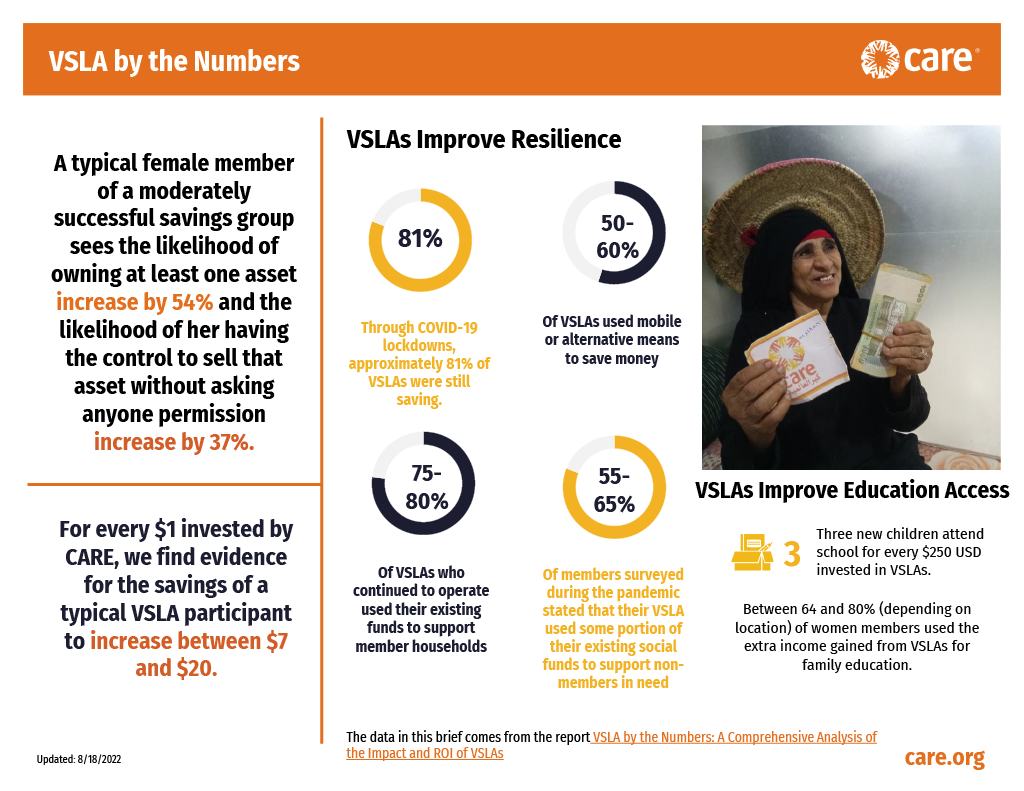

Through VSLAs, members can access credit for income-generating activities, emergencies, and other needs. VSLAs are a powerful tool for promoting financial inclusion, building social capital, and supporting economic development in underserved communities.

At Care, we recognize the importance of VSLAs and the role they play in advancing financial inclusion. That’s why we have developed a digital solution that leverages the power of technology to enhance and expand VSLA operations.

Greater Financial Inclusion

Village Savings and Loan Associations (VSLAs) have been an effective tool for financial inclusion in rural areas for many years. By creating a community-based savings and lending system, VSLAs have allowed individuals who are typically excluded from traditional banking systems to access basic financial services.

Our digital solution builds on this model by providing a user-friendly platform that streamlines the savings and loan process, making it easier for members to participate and benefit from their VSLA. This leads to greater financial inclusion and economic empowerment for individuals and communities.

The Challenges with Traditional VSLA

While traditional VSLA has been a very successful way to increase financial inclusion in underserved communities, there are several challenges that limit its impact and scalability. Some of these challenges include:

- Lack of credit score: Without a formal credit scoring system, members of traditional VSLA may not have access to credit beyond the group, limiting their ability to start or expand a business.

- Possibility for theft: Since transactions are handled with cash, there is a risk of theft or loss of funds. This can be especially damaging for low-income individuals who may not have the means to recover financially.

- Human calculated bookkeeping: Bookkeeping for traditional VSLA is usually done manually, which can lead to errors and inconsistencies in records.

- Inefficient transaction tracking: Transactions are often recorded on paper, making it difficult to track and analyze financial data. This limits the ability to identify trends and make informed decisions for the group.

- Limited by physical reach: Traditional VSLA groups are often limited by physical distance, making it difficult for members to participate if they are not located in the same area.

- Limited access to financial services: Traditional VSLAs are often limited to a local community, which can restrict access to formal financial services and products. This can make it difficult for members to access credit, insurance, and other financial services that can help them grow their businesses and improve their economic well-being.

- Scalability: Traditional VSLAs are typically limited in size and scope, which can restrict their ability to grow and scale over time. This can limit their impact on the community and prevent them from achieving their full potential.